Here is the updated presentation for Alabama Wills and Trusts provide in a seminar yesterday.

Tag Archives: Wills

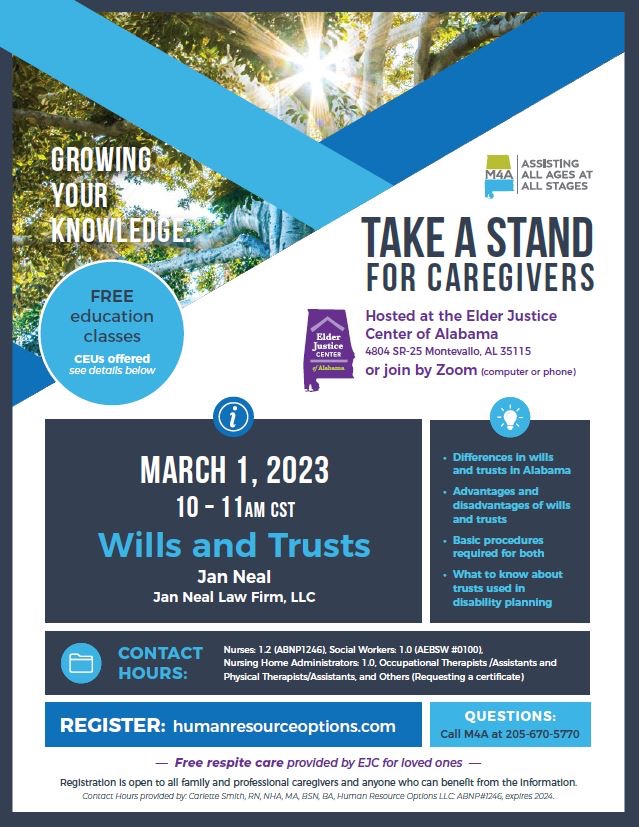

Upcoming Training on Wills and Trusts in Alabama

I will be providing online training on March 1, 2023, at 10:00 a.m. CDT for Middle Alabama Area Agency on Aging’s Take a Stand For Caregivers initiative. There is no cost for attending, and while some professionals can receive continuing education credit, registration is available for anyone who can benefit from the information. Hope to see you there.

Do You Need a Will or a Trust?

I will be speaking on Wills and Trusts at the Shelby County Senior Health and Wellness Exhibition in Columbiana on 10/13/22 from 10:45 – 11:15. The event will be at the First Baptist Church of Columbiana, 208 N Main St, Columbiana 35051 from 9:30 – 1:00. After the presentation I will make available my slide presentation covering the pros and cons of wills vs. trusts on this web site, Facebook and our Slideshare Account.

The Importance of a Will in Second Marriages

If a person dies without a will, or if the will is not probated within five years of death, then property in his or her probate estate will be distributed by rules determined by the legislature, known as the law of intestacy.

The law of intestacy in Alabama requires that the estate of a person having children by a previous marriage be divided one-half to the current spouse and one-half to the child or children by a previous marriage. This can create some totally unforeseen consequences for a couple in a second marriage with children by that marriage. The children of that union will take nothing under the law of intestacy while a child from a previous marriage will take one-half.

It is important to evaluate your individual situation to determine what is at risk if you die without a will and how you can structure your assets to assure your property passes in the manner you prefer.

Publication on Planning for Death

No one wants to plan for it, but death is inevitable. To be sure your loved ones are protected and your assets pass as you wish, you need to understand asset titling and the probate process. This publication is Alabama specific and provides an overview of the ways property can be passed at death. This document can be read online or downloaded and printed. It will remain available in the Publications at this web site.

Wills and Beneficiary Designations Work Together to Distribute Your Estate

While a will is an important document to have in any estate plan, the reality is that most property passes to heirs through other, less formal means. Failure to recognize this fact can result in some unintended consequences in estate distributions.

While a will is an important document to have in any estate plan, the reality is that most property passes to heirs through other, less formal means. Failure to recognize this fact can result in some unintended consequences in estate distributions.

Many bank and investment accounts, as well as real estate, can be titled to joint owners who take ownership automatically at your death. Other banks and investment companies offer “payable on death” accounts that permit owners to name the person or people who will receive the account funds when the owner dies. Life insurance, of course, permits the owner to name beneficiaries. Some real property is titled to joint owners with rights of survivorship so that when one owner dies, the other takes full ownership of the property. A future interest in property can be transferred during a person’s life, subject to a life estate held by the transferor, so that when the life estate holder dies, the property is owned by the person/s to whom the future interest was given. No probate would be necessary.

All of these types of ownership and beneficiary designations permit these accounts and types of property to avoid probate, meaning that they will not be governed by the terms of a will. When taking advantage of these simplified procedures, owners need to be sure that the decisions they make are consistent with their overall estate plan. It is not unusual for a will to direct that an estate be equally divided among the decedent’s children, only to find that because of joint accounts or beneficiary designations, the estate is distributed unequally, or even to non-family members, such as new or old boyfriends and girlfriends.

It is also important to review beneficiary designations every few years to make sure that they still reflect your wishes. An out-of-date designation may leave property to an ex-spouse, to children who disappeared from you life while other children provided care, to ex-girlfriends or ex-boyfriends, to relatives who are on means tested public benefits who will lose those benefits by inheriting, and to people who died before the owner. All of these failures to make proper designations can thoroughly undermine an estate plan and leave a legacy of resentment that most people would prefer to avoid.

These concerns are heightened when dealing with retirement plans, whether IRAs, SEPs or 401(k) plans, because the choice of beneficiary can have significant tax implications. These types of retirement plans benefit from deferred taxation in that the income deposited into them, as well as the earnings on the investments, are not taxed until the funds are withdrawn. In addition, owners may withdraw funds based more or less on their life expectancy, so the younger the owner, the smaller the annual required distribution. Further, in most cases, withdrawals do not have to begin until after the owner reaches age 70 1/2. However, this is not always the case for inherited IRAs. To further complicate matters, the spouse has a right to funds in a 401(k) that must be disclaimed by waiver after marriage to prevent their having rights to those funds even if you named someone else as your 401(k) beneficiary.

Following are some of the rules and concerns when designating retirement account beneficiaries:

- Name your spouse, usually. Surviving husbands and wives may roll over retirement plans inherited from their spouses into their own plans. This means that they can defer withdrawals until after they reach age 70 1/2 and take minimum distributions based on their age. Non-spouses of retirement plans must begin taking distributions immediately, but they can base them on their own presumably younger ages.

- But not always. There are a few reasons you might not want to name your spouse, including the following:

- He or she is incapacitated and can’t manage the account

- Doing so would add to his or her taxable estate

- You are in a second marriage and want the investments to benefit your first family

- Your children need the money more than your spouse

- Consider a trust. In some circumstances, a trust would be appropriate, providing for management in the case of an incapacitated spouse, permitting assets to benefit a surviving spouse while being preserved for the next generation. Those in first marriages may want to name their spouse as the primary beneficiary and a trust as the secondary, or contingent, beneficiary. Transferring assets to a trust can also be used to plan for long-term care expenses if planning is done early enough (five years before you or your spouse need nursing home care).

- But check the trust. Most trusts are not designed to accept retirement fund assets. If they are missing key provisions, they might not be treated as “designated beneficiaries” for retirement plan purposes. In such cases, rather than being able to stretch out distributions during the beneficiary’s lifetime, the IRA or 401(k) will have to be liquidated within five years of the decedent’s death, resulting in accelerated taxation.

- Be careful with charities. While there are some tax benefits to naming charities as beneficiaries of retirement plans, if a charity is a partial beneficiary of an account or of a trust, the other beneficiaries may not be able to stretch the distributions during their life expectancies and will have to withdraw the funds and pay the taxes within five years of the owner’s death. One solution is to dedicate some retirement plans exclusively to charities and others to family members.

- Consider special needs planning. It can be unfortunate if retirement plans pass to individuals with special needs who cannot manage the accounts or who may lose vital public benefits as a result of receiving the funds. This can be resolved by naming a special needs trust as the beneficiary of the funds, although this gets a bit more complicated than most trusts designed to receive retirement funds. Another alternative is not to name the individual with special needs or his trust as beneficiary, but to make up the difference with other assets of the estate or through life insurance.

- If probate will be necessary, leave an account jointly titled with your personal representative to provide expenses during probate. If your home needs to be sold, funds will need to be available to pay property tax, insurance, utilities, etc.

- Keep copies of your beneficiary designation forms. Don’t count on your retirement plan administrator to maintain records of your beneficiary designations, especially if the plan is connected with a company you worked for in the past, which may or may not still exist upon your death. Keep copies of all of your forms and provide your estate planning attorney with a copy to keep with your estate plan.

- But do name beneficiaries! The biggest mistake many people make is not to name beneficiaries at all, or they end up in this position by not updating their plan after the originally-named beneficiary passes away. This means that the plan will have to go through probate at some expense and delay and that the funds will have to be withdrawn and taxes paid within five years of the owner’s death.

In short, while wills are important, in large part because they name a personal representative to take charge of your estate and they name guardians for minor children and disabled spouses, they are only a small part of the picture. A comprehensive plan needs to include consideration of beneficiary designations, especially those for retirement plans.